The Startup Path to Success

Why joining an early-stage startup can beat the best big-tech offer.

Welcome to the 163 new subscribers who have joined our community of 50,282 readers! If you haven’t subscribed, join us below:

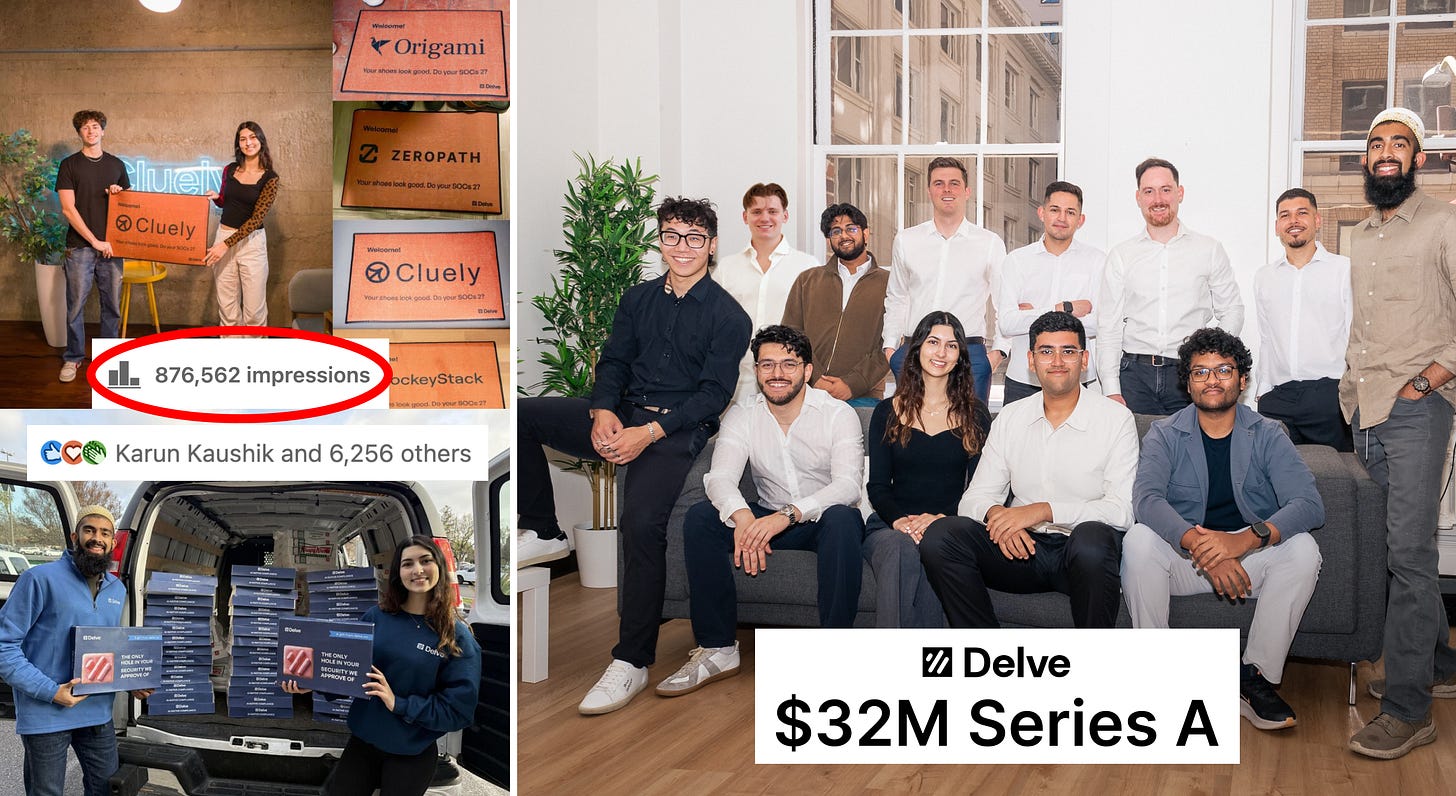

🖥️ Today’s issue is brought to you by our sponsor, Delve.

We’re thrilled to announce our $32M Series A at a $300M valuation, led by Insight Partners! Delve is shaping the future of compliance with an AI-native approach that cuts busywork and saves teams hundreds of hours. Startups like Lovable, Bland, and Browser Use trust our AI to get compliant - fast.

To celebrate, we’re giving back with 2 limited-time offers:

→ $2,000 off compliance for new customers – claim here.

→ $15,000 referral bonus if you refer a founding engineer we hire.

Thank you for your support. This is just the beginning.

Get compliant with Delve today.

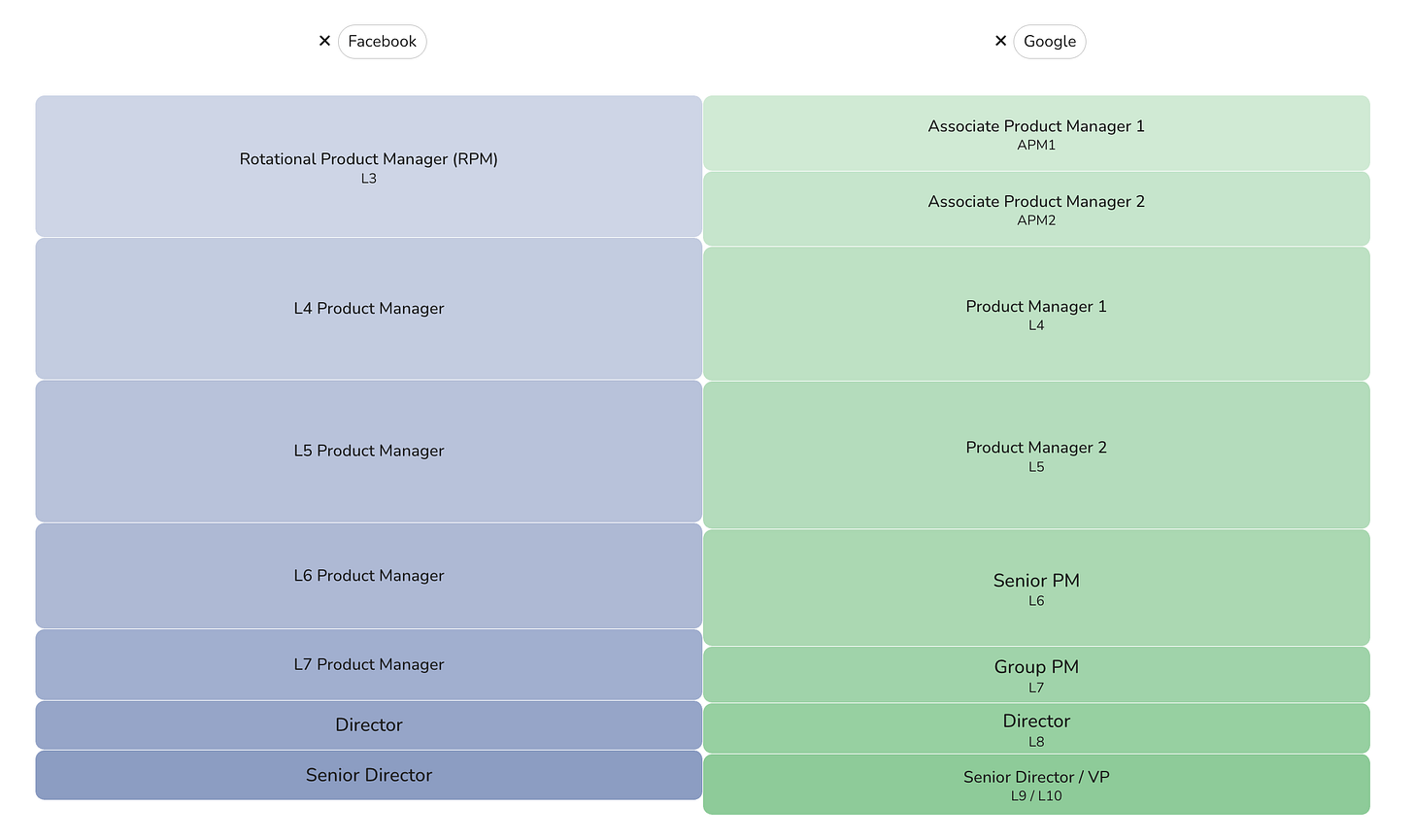

I spent the first five years of my career chasing prestige, landing at Meta, then Google, for the stability, benefits, and six-figure paychecks.

I was told that working at a “blue chip” company was the only path to success. Despite the great title, perks, and decent lifestyle it afforded, I still felt stuck running on a treadmill.

Meanwhile, a few friends took chances on startups, found more fulfilment, learned more skills, and walked away with life-changing money. They didn’t retire to a beach but became “post-economic”, and money no longer dictated their decisions. Watching them taught me that a small equity stake in the right team can outpace even the best big tech offer.

Picking the right startup takes experience, research, analysis, and access. It’s not easy. But when it pays off, it can have massive impacts on your life.

Today, I’ll talk about the Startup Path to Success and why choosing to work for a startup can be a great decision, not only for creating a good economic outcome, but also for accelerating your learning and career.

The Case for Startups

Big‑tech roles pay well but cap your upside. Even with annual bonuses and RSUs, you’re still trading time for dollars. Over ten years, a Google PM might earn $4 million pre‑tax, a salesperson $2 million, and an engineer $5 million. Sounds great, until you realize most people save only about 8% of their pre‑tax income. On $4 million, that’s just $320,000 after a decade set aside before interest and capital gains.

Early‑stage startups flip that model: you accept a lower salary in exchange for the chance at life‑changing liquidity.

As a mid‑level operator joining around the 100‑employee mark, here’s what you might see:

Scale AI – Joined ~100 people in mid-2018; sold in the $25 billion tender offer (March 2025) → $8 M–$12 M

Slack – Joined at Series C (~mid 2016); held through the $27.7 billion sale to Salesforce (late 2020) → $5 M–$8 M

LinkedIn – Joined at ~100 headcount (circa 2008); exited on the $26.2 billion Microsoft deal (2016) → $9 M–$12 M

Uber – Joined at Series D (~2015); rode into the $82 billion IPO (mid 2019) → $30 M–$45 M

Snowflake – Joined ~100 employees (mid 2018); held through the $70 billion IPO (Sept 2020) → $20 M–$30 M

*All figures assume standard four‑year vesting, a 30 percent dilution buffer, and no refresh grants.

Obviously, these outcomes are extremely rare. Up to 90% of startups fail within five years, meaning only about 10% survive long enough to hit a major liquidity event. And even among survivors, only around 16% of companies ever get acquired by the Series E stage.

This makes spotting the right opportunity (and holding through to the end) critical if you want your small equity stake to turn into an outsized outcome.

However, there is another argument to be made to make a bet on a startup.

Accelerated Career Advancement

Startups can also offer faster career advancement and promotions, skill development, and, in some cases, salary growth.

Why?

In a small team, there’s no one else to pick up the slack. If you join as an individual contributor, you’ll quickly find yourself owning projects end to end, and put in positions that large companies usually reserve for senior hires.

You won’t waste quarters waiting on committees or endless meetings to get sign‑off. Decisions happen in days, not months, so you learn to iterate, pivot, and deliver impact almost immediately. That rapid feedback loop accelerates your learning curve and makes you indispensable.

Early employees often get tapped to build and lead teams because they already know the product, the customers, and the culture. It’s possible to go from individual contributor to Director (managing a team of ten) in five years, whereas on the big-tech track, it can easily take over a decade.

I’ve seen it myself: friends who left Google, Uber, and Microsoft for startups often tell me they learned more in their first six months than they did in years at a FAANG. They took on leadership roles, shipped critical product features, and built networks that positioned them for even bigger opportunities down the road.

Liquidity Events Explained

But how does startup equity translate into cash?

You’ve seen how powerful these outcomes can be if you joined fairly early. Let’s take a look at the mechanics behind these returns… this is how founders, employees, and investors actually turn startup equity into real money:

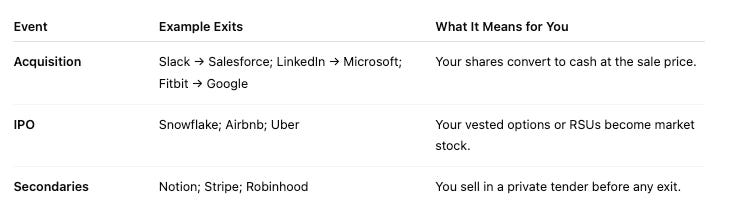

Acquisition

When a buyer steps in, your equity converts to a lump‑sum payout. Slack’s $27.7 billion sale to Salesforce, LinkedIn’s $26.2 billion acquisition by Microsoft, and Fitbit’s $2.1 billion purchase by Google are good examples.IPO

Going public unlocks tradable shares. Snowflake raised $3.4 billion on day one, Airbnb debuted at a $100 billion market cap, and Uber launched with an $82 billion valuation. Vested employees can sell into the open market—and in some cases, watch their initial grants double in value before lunch.Secondaries

Private‑market buybacks let you cash out long before any acquisition or IPO. Notion’s $10 billion secondary, Stripe’s $65 billion tender offer, and Robinhood’s $55 billion pre‑IPO trades all gave employees liquidity without waiting for a traditional exit.

How to Pick Your Path

Most people assume there is only one path to career success, and they chase the logos splashed across TechCrunch and Business Insider. But there is massive upside with startups that few even notice. With a bit more effort and independent thinking, you can find those hidden gems—and see massive gains in your career, your skill set, and maybe even your wallet.

Of course, predicting the next unicorn is insanely hard, and few have nailed it. Still, there are signals most people miss … once you learn to spot them, your odds of choosing the right company go way up.

Develop Your Thesis

Start by choosing an industry you believe in and love, whether it’s healthcare, fintech, or consumer. Then narrow down on a specific niche where you feel like you can spend hours learning about the space without getting bored. This will be your unfair advantage that will let you go deep into the space.Track the Right Signals

Follow the CEOs and leaders on social media. Read their newsletters and stay informed with fundraising and product launch announcements. These early funding rounds often pinpoint a moment where they are about to accelerate and start hiring quickly. Pro tip: Y Combinator, StartX, and the Thiel Fellowship have a great track record of producing unicorns.Build Insider Access

Once you have your “target list” of companies you want to work for, start reaching out to the decision makers there. Show up at demo days, industry meetups, investor events, and even cold outreach to the founders, offering a way to be valuable to them. Attend relevant events (including mine), and build your relationships.Join at the Right Stage

Getting in early often makes the difference between a good equity outcome and a life-changing one. Roles before Series A carry the biggest upside but the biggest risk since the company is still finding product-market fit. Series B to C positions balance risk and reward as you join after initial traction but before valuations skyrocket. Series D and beyond offer more stability and clearer liquidity paths, though your equity slice will be smaller. Decide which stage aligns with your risk tolerance and career goals and target teams accordingly.Vet Founders & Teams

Evaluate companies like you would if you were investing in them. Look for founders who have built or scaled successful companies before or operators with deep domain expertise. Reach out to current and former employees to learn about the company culture, runway, and leadership style. The right team will be transparent about risks and realistic about how they plan to win.

That’s your playbook in a nutshell: pick a space you care about, watch for the early signs, get to know the insiders, jump in at the right moment, and evaluate the team like you’re doing your own startup due diligence.

Obviously, this is not guaranteed - you won't find a unicorn, but you'll be making smarter bets, which means better career moves, learning skills you can't learn anywhere else, and the chance at a significant financial payday that most people will never see.

P.S. Some venture funds, including the one I invest out of, will share updated lists of startups that they are most bullish on. Sharing some below for you as a starting reference point.

Flybridge Capital – Rocketship Startup List 2025

Topstartips.io – Full list

P.P.S. For a head start on choosing awesome startups to work for, check out my job listings below. Most of these companies are either ones that I’ve invested in or have had on my radar for a while.

📌 Andrew’s Bookmarks

Important links to help you become wiser and more creative.

Your Company Name Matters…a Lot by James Currier – A good is more than just branding. It shapes how people talk about you, remember you, and believe in what you’re building. Currier breaks down what makes a name stick, plus examples of what to avoid. Worth a read.

Flounder Mode by Brie Wolfson – When you’re building a company early on, everything is messy… no clear path, no traction, just a bunch of half-baked ideas. This piece puts a name to that stage: flounder mode. It’s a reminder that wandering isn’t failure. It’s part of the work.

How to see the humanity in anyone by Scott Shigeoka – It’s easy to judge others. The harder t hing to do is to stay surious. Whenever I find myself forming a judgement, I try to require my brain to lean in with curioisty instead. It’s served me well.

3 Human Skills That Make You Irreplaceable in an AI World by Scott Galloway – AI can do a lot today, but it can’t build relationships or tell a great story. Scott’s point: The human skills of communication, judgement, and emotional presence will matter more than ever.

The Connection Economy Playbook by Andrew Yeung – I partnered with HubSpot to put together a free playbook on how you can build your network and use it to accelerate your career, which includes DM templates, personal branding toolkits, and even an event design guide.

💼 Job Board

Sharing job opportunities that my friends are hiring for. If we know each other well, DM me and I can connect you directly.

Head of Operations, Boost My School

Chief of Staff to Erik Torenberg (GP), Andreessen Horowitz

Chief of Staff to Auren Hoffman (Former CEO of LiveRamp)

Growth Hacker/GTM Lead / Account Executive / General Manager, V7

Sales, Social, Marketing, Growth, Networks, and Talent Roles at Andreessen Horowitz (DM me directly if we know each other)

Founding Head of Growth, SwitfSku

Founding Growth Lead, Superpower

Head of Creator Partnerships & Influencer Marketing, Superpower

Head of Product, Superpower

Head of GTM, Elloe

Staff Product Manager, Sydecar

Social Media Manager, Rho

Senior Business Analyst, Monday.com

Senior Performance and Growth Marketing Leader, Alinea Invest (reach out to eve@alinea-invest.com)

Customer Success, Product & Marketing, Cloudflare

Have a job to share? Let me know by replying to this email.

👉 Btw, if you want to be part of our partner talent network, next play, and get curated job opportunities in your inbox, please sign up here.

💃 Community Perks

🏃 Achieve peak health and performance. Improve your routine by tracking 100+ biomarkers to get a comprehensive view of your body and become healthier + more productive with Superpower – a company I invested in! Use ANDREW100 for $100 off.

🍽️ Love dining out? Get up to 30% off your bill at top restaurants in NYC and most US cities with InKind. It’s the ultimate dining app for foodies—earn up to 30% back when you eat out, plus get $50 off your bill every month at select spots. And as a bonus, we both get $25 free when you sign up. Sign up here.

💳 Sign up for the AMEX Platinum and earn 80K points when you spend $8K in 6 months. Sign up here.

🇺🇸 Looking for a US immigration lawyer? Reply here for an introduction to the lawyers I recommend for O1A/EB1 visas.

🚴 Discounted Equinox membership in NYC. Reply here for a free trial and discounted membership.

What other perks should I include? Let me know...

🖼️ Behind the Scenes

We’re taking over Sharon Stone’s former Seacliff mansion in San Francisco.

August 13–14. We’ve partnered with Wefunder to host a series of beach workouts, fireside chats (speakers to be announced), and dinners for founders at the mansion.

Also, we still have room for sponsors/partners!

This post hits on several great points around career benefits outside of the monetary. When I left blue big (IBM) for my first startup (family office hedge fund) I also signed onto my first management role (managed two analysts and our banking, broker, and other vendor relationships). I learned so fast it set me up for going in directly as COO at my first tech startup where I got to manage about 20 people across sales, marketing, finance, and product. Working with investors and the board is another unique experience most corporates don’t offer except to a small few employees. Now I’m at MemVerge, an AI infra and GenAI software company that is changing the world one GPU and AI agent at a time. I came in less than three years ago as a director, then become senior director where I started managing a team and am now a vice president with a great team I got to hire myself. To infinity AI and beyond 🤓.